Keighley and Ilkley’s MP Robbie Moore has led opposition calls in Parliament against the government’s “family farm tax”, warning the move threatens to hand the next generation of farmers and “impossible tax bill” and calling for a full impact assessment of Labours plans.

It comes after an announcement by Chancellor Rachel Reeves to remove Agricultural Property Relief (APR) on farms valued over £1 million, a change unveiled in last week’s Budget.

The National Farmers' Union (NFU) said it had been a “disastrous budget” for family farms, that would “snatch away the next generation’s ability to carry on producing British food” and see farmers forced to sell land to pay the tax, whilst the CLA called it a “catastrophic betrayal”

Many have gone onto social media to express their dismay, as well as broadcasters Jeremy Clarkson and Kirstie Allsopp, who said the decision showed the government had "zero understanding of what matters to rural voters".

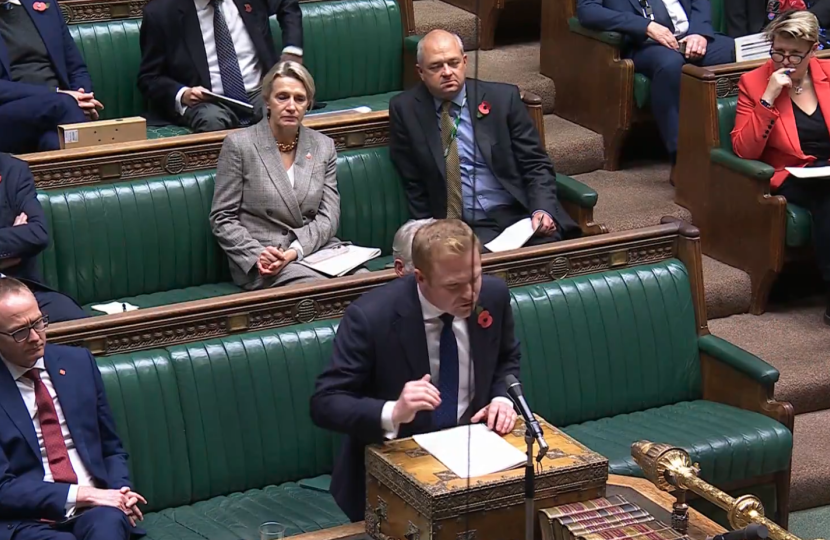

In an address to Parliament, Mr Moore highlighted the serious impact these tax changes could have on small family farms, arguing that “the vast majority of farming families are not multimillionaires. Most are cash poor and many are struggling to break even.”

Farmers are often land-rich but cash-poor; with an average farm valued around £3 million. The impact of the changes to inheritance tax means that from April 2026, the average family farm will have a £400,000 tax requirement to pay on the £2 million above the threshold.

In response to Mr Moore’s speech, the government pointed to Treasury figures showing that a minority of farms would be impacted, insisting that family farms would remain protected. The chancellor has also claimed that 72% of farms would be unaffected.

However, the National Farmers Union and the Country Land and Business Association disputed the figures this week. The NFU argues that cash-poor, medium-sized family farms will be unaffordably hit if the rate remains at £1m, and pointed to Defra figures, which it said indicated that the true percentage of farms affected by the APR changes will be 66%.

In an emergency meeting with the environment secretary, Steve Reed, on Monday, the NFU’s president, Tom Bradshaw, demanded the new rules be withdrawn and put to consultation with the agricultural industry and Defra experts so that a solution that does not sting family farms can be found.

Robbie Moore MP said:

“Over the weekend we’ve heard gut-wrenching stories from farmers up and down our nation who feel completely and utterly betrayed by the new Labour government’s budget measures – and are now fearing for their family's future in farming.

What the government have failed to realise is that the vast majority of family farmers aren’t multi-millionaires — most are cash poor, most operate under margins of £50,000, and many are struggling to break even. That means our next generation of farmers will be handed an impossible tax bill – and forced to sell off farms that have produced food for our nation for generations

That’s exactly why this week in the House of Commons, I stood on the side of farmers and urged the new government to reverse their disastrous budget measures for farmers.”